SPORTS NEWS

As a hotelier, you know many factors go into your room rates. Three of those factors are your costs, current demand, and your hotel’s online visibility. Revenue management is the science of assessing these and other factors and raising your profitability year after year. This article offers a guide to analyzing your costs and improving your analysis with the goal to boost your hotel’s profitability.

Quick Menu:

- What Kinds of Hotel Costs Do You Take Into Account When Pricing Rooms?

- What Is Revenue Management?

- Common Misconceptions

- Consider Your Fixed Costs

- What About Those Variable Costs?

- CostPAR vs RevPAR

- CostPAR vs. Bottom Rate

- Variable Costs vs. Bottom Rate

- CostPAR, RevPAR, ADR, and The Hotel’s Online Reputation

- A Long-Sighted and Holistic View of Performances

- Bottom Rate vs Rack Rate

What Kinds of Hotel Costs Do You Take Into Account When Pricing Rooms?

Those new to the revenue management concept often ask questions like this. It’s an excellent question. Costs are some of the main factors to be considered in revenue management along with:

- Quality

- Competition

- Market trends

- Events

- Historical performance

- Forecasting

- Dynamic evolution of initial pricing

What Is Revenue Management?

Let’s define the term revenue management first, so there’s no confusion.

Revenue management is defined as the art of selling the right room, to the right client, at the right moment, for the right price, through the right distribution channel with the best cost efficiency. It’s the science of profitability.

Revenue management applies to every sector that presents some characteristics. From high fixed costs and low variable costs to perishable inventory, every night a room goes unsold is a permanent loss of revenue. After all, a room that goes unsold today can’t be sold tomorrow.

Hotels also have limited supplies. For example, if you have 100 rooms, you cannot expand or contract your capacity according to the demand. In low-demand periods, you may want fewer rooms to sell. Then, in high-demand periods, you’ll want more rooms to satisfy the demand.

Fixed and variable costs versus quality, what a mess! Enter revenue management. Let’s dig into some of the common misconceptions.

Common Misconceptions

Many hoteliers approach the concept of revenue management with arguments like: “I cannot sell below a certain rate because I can’t cover costs. I have huge costs.” Or “I cannot sell below a certain rate, because I lose value and the guests will perceive a lower quality, and I will attract low-quality guests, I prefer to keep my room empty or stay closed.”

These arguments often hide the misconceptions that revenue management means selling every day at low prices. That’s not what it means at all. Some hoteliers also think their prices determine the quality of the property and their guests. The higher the prices, the better the property and the guests. Yet, it’s more complicated than this.

Revenue management does not aim to sell at low prices (that’s the low-cost or budget economy purpose, another thing entirely.) Instead, the goal of revenue management is to sell every room every day at the best possible price. The quality of a property is determined by what guests feel and express in their reviews.

Consider Your Fixed Costs

When we talk about fixed costs, we refer to those costs that remain the same regardless of the volume or number of rooms sold.

For example:

- Rent/mortgage.

- Insurance and taxes.

- Fixed monthly bills, like TV and internet.

- Staff salaries and other payroll costs.

- Marketing/advertising costs.

Let’s take the total fixed costs of any accommodation, hospitality, or lodging facility, divide them by the number of rooms and then by the number of working days (e.g., $ 1.000.000 / 100 rooms / 365 days = $27).

That small 2-digit number represents the daily fixed unit cost that each room costs you, whether it’s occupied or not.

Revenue management requires a different frame of reference. Instead of thinking, “unsold room,” you’ll think “permanent loss of money.” That’s a significant shift.

What About Those Variable Costs?

Now, let’s look at the variable costs. These are the costs that vary with your business volume and that the hotel incurs only if the rooms are occupied by some guests.

For example:

- The room courtesies: slippers, pencils, pens, notebooks, etc.

- Bath courtesies: soaps, bath foam, caps, toilet paper, etc.

- Laundry: sheets, pillowcases, towels, etc.

- Utilities: water, electricity, and any gas

- The breakfast (the food cost) when included in the room rate

- The possible room cost for a housekeeping attendant if you use outsourced service (i.e., relying on companies to recruit attendants.)

- Sales channels commissions

Let’s take the total variable costs in one year and divide them by the number of rooms and then by the number of working days (e.g., $500.000 / 100 rooms / 365 days = $14). This figure represents the variable unit cost or variable cost per room per day.

CostPAR vs RevPAR

With the fixed and variable costs in mind, you can consider the RevPAR (Revenue Per Available Room) and its “twin brother,” CostPAR (Cost Per Available Room.)

Calculating the CostPAR is easy and helps you see the cost situation. When you compare CostPAR and RevPAR, you’ll have an immediate grasp of the hotel’s economic situation.

For example, RevPAR determines the amount of revenue generated by each room (whether empty or sold) in a single period of time (day, week, month, etc.) and is calculated by taking the room revenues and dividing it by the total number of available rooms and open days. CostPAR indicates costs on a single unit per time period, for example, per day. It is in fact calculated by taking the total costs (variable and fixed) and dividing them by the total number of available rooms and the number of opening days.

In the example above, you take the total costs (variable and fixed) in one year and divide them by the number of rooms. Then by the number of working days, you obtain a CostPAR of $41 (e.g., $1.500.000 / 100 rooms / 365 days = $41.)

CostPAR can be calculated both on a historical basis once the year is over and forecast when making the budget for next year.

Now the question is, how should this influence pricing when you compare it with other data like historical performance and forecasting?

Of course, you need to know your bottom rate. The bottom rate is the rate below which you cannot sell a room because it would be an economic loss. Next, you’ll ask, what’s your starting rate for the next 365 days? You can apply this for each room type.

Following this logic, imagine that RevPAR (revenue per available room) on a unit basis is higher than CostPAR (cost per available room.) In this case, room revenues exceed costs, and your hotel will make a profit.

CostPAR vs. Bottom Rate

There’s a school of thought that to achieve such results and be profitable, the bottom rate should always be above the CostPAR (even $1), or at least never below it.

That makes sense on the surface.

Yet, dig deeper, and you realize the problem with this thinking. It’s based on the assumption that you can reach 100% occupancy every day of the year at that price or above.

However, you know, hotel demand and offer are always variable. Guests don’t care about hotel internal costs when booking a room. There might be periods where the market is willing to pay well below your set CostPAR and other periods well above. Revenue management finds the right balance between prices, commercial offers, and other factors that help you get profit margins and a positive financial mark at the end of the year.

Let’s take two hotels.

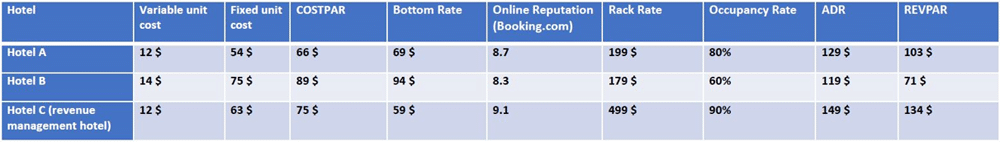

The above table demonstrates that hotel B has higher variable costs and a greater fixed unit cost. Perhaps it’s because of a poor cost rationalization or simply because the hotel has fewer rooms, thus its fixed costs are less spread out.

This situation causes a minimum rate of $94 for Hotel B, some $5 over the CostPAR. This gives it a competitive disadvantage versus hotel A, and it’s challenging to drive demand during weak periods as the rate may be out of the market.

So, would it be advisable to price rooms always above CostPAR? Of course not! Let’s explore.

Variable Costs vs. Bottom Rate

Another school of thought says the only cost consideration is the variable cost per room.

In the experience of Franco Grasso Revenue Team, statistically speaking, in a 3- or 4-star hotel, this cost should ideally range between $10 and $20. When it exceeds these numbers, there might be some problems of cost rationalization to fix. On the other hand, trying to compress costs too much could lead to a disruption in service and deterioration of perceived quality. This can lead to bad reviews, loss of reservations, and therefore revenues. It’s a negative spiral.

Fundamentally, if you can sell a room above your variable unit cost, that improves your revenue and it’s better than an empty room.

A caveat: we’re not suggesting hoteliers sell rooms at only $1 above the variable cost only to avoid an empty room. However, if they did so, there would be no loss. Of course, this approach only works during specific times of the year and with a clear goal and careful analysis in place.

Every hotel faces low demand and high demand periods, and you want to remain profitable throughout both. By selling a room even $1 or $2 above the variable room cost during low demand can help cover some of the fixed costs during those periods. It also has the advantage of triggering commercial actions that help you maximize results during high-demand periods. Now, the real profits can roll in.

Let’s apply this thinking to a hotel in shoulder season. Historically, their data shows an occupancy rate of 50% at an ADR (average daily rate) of $80 and a RevPAR of $40 (RevPAR = ADR*Occupancy rate.) The hotel defines its Bottom rate at $59, which is below its forecasted CostPAR of $75, but way above the variable unit cost ($12). They decide to apply this so-called bottom rate to their rooms in the low-demand shoulder season.

As a result, the hotel improves its historical performances by achieving 80% occupancy and a RevPAR of $47 (RevPAR=ADR*Occupancy rate). They’re still below the CostPAR (75-47=$23). However, other factors should be considered.

CostPAR, RevPAR, ADR, and The Hotel’s Online Reputation

An additional benefit of revenue management is one you may not think about. Yet, it’s an essential element to the entire process of increasing profits. That element is the increased positive reputation and, therefore online visibility. Here’s how it works. Let’s say you’re following the variable unit cost model.

Let’s say this improved occupancy in April and May translates into more guests staying at the hotel. With more guests, more ancillary services are sold (bar, restaurant, room service, spa, etc.) which make up for the lower room rates. Equally important, there are more reviews. Let’s say these reviews turn out to be all positive due to the excellent service and perceived value for money. As a result, your guests leave positive reviews, which raise your online scores. For example, your hotel enjoys a shift from 8.9 to 9.1 on Booking.com or from 4.7 to 5 on Tripadvisor.

That can pay off in terms of more guests year-round because your hotel has more online visibility. More online visibility translates into more guests and more reviews in a virtuous circle.

As we all know, guests and future guests rely heavily on reviews to choose their hotel. Search engine algorithms reward those hotels with high review scores on Booking.com, Tripadvisor, and Google by boosting them in the search results. Therefore, more people see the hotels and their excellent reviews online.

These reviews trigger more bookings, more reviews, and so on.

Many studies show that the determining factor in choosing one hotel over another is the quality of the online score. For example, many online users filter their search results by score. For instance, they’ll use Booking.com and only want to see the hotels with a 9+ rating or 4+ on TripAdvisor. Or they’ll use another sorting mechanism such as 4-star hotels with breakfast, parking, free cancellation, or other amenities.

These online scores impact the number of bookings and conversion rate and the ADR (average daily rate) a hotel can sell. This is especially true in high-demand periods and during events. The higher the score, the higher the potential sales price accepted by the market to book that property. And all things being equal, more than 80% of people choose to pay slightly more for the property with the highest score.

Here’s an example. Let’s say the historical performance of July and August indicates an occupancy rate of 100% at an ADR (average daily rate) of $140 and a RevPAR of $140 (with 100% occupancy ADR and RevPAR coincide). The positive shift in online reputation achieved in April and May gives this hotel more visibility. Now, it’s able to sell at an ADR of $200 in July and August with full occupancy.

Does that make sense so far? By incorporating revenue management practices in low season you helped cover some fixed costs. You’ve also boosted the hotel’s visibility in the search engines. A few weeks later, you can increase room rates to meet demand during the high season, thus increasing profitability.

In this example, this high season July-August period has a RevPAR of $200 against a CostPAR of $75. This makes for a $125 surplus that accounts for the negative gap of $23 back in April and May.

However, the two work together. By selling rooms at the bottom rate of $59 in April and May made it possible to reach that premium ADR in July and August.

A Long-Sighted and Holistic View of Performances

As you can see, revenue management looks at the entire opening season of a hotel or the entire twelve months of the year if the hotel is open year-round. A price applied on one particular day does not say anything about the overall final result.

It’s not only about the high season, low season, or market conditions. Revenue management affects the hotel’s online visibility too. Reviews’ quantity and recency are as important as quality in online channels, so it’s essential to have many high-quality and fresh reviews. It’s a sign of more credibility and reliability for algorithms. Six-month-old reviews don’t carry the same weight as those from yesterday.

Hotels that regularly collect a lot of positive reviews rank higher in the search engines.

So, the argument that to get higher occupancy you need to lower your prices and ADR is not always applicable.

When you look at the big picture and put excellent online reputation into the equation, then more occupancy = more positive reviews = more visibility = higher prices and ADR.

Bottom Rate vs Rack Rate

If the bottom rate turns out to be lower than competitors, then the rack rate might be much higher than the competitors. Of course, the rack rate is the maximum rate at which a few rooms can be sold during a year, for example in peak periods or during events. When revenue management is applied correctly, and the property boasts an excellent online reputation and service in all aspects, the hotel can sell rooms for extremely high rates.

In this table, we’ve added the above-mentioned hotel using revenue management to the previous comparison table. We’ve also added a few other yearly parameters like online reputation, the rack rate, the occupancy rate, the ADR, and the RevPAR.

This table compares three hotels on a unit value, as it allows for a reliable comparison among hotels regardless of the number of rooms. You can see that having a Bottom rate exceeding the CostPAR does not always mean closing the year with a profit. Hotel B ends up having a yearly RevPAR ($71) far below the CostPAR ($89)

This hotel will likely record a negative yearly Gop (Gross Operating Profit) or GopPAR (Gross Operating Profit per available room)

You can calculate GopPAR by dividing gross operating profit by the total number of rooms available. It’s a solid indicator of overall business performance across all revenue streams.

Not only can you see that having a Bottom rate exceeding the CostPAR does not mean being profitable, but also a higher bottom rate does not always translate into having a better annual ADR and RevPAR compared to other hotels. Equally important, it does not always translate into better quality, as what really counts is the score given by guests through their reviews, and not hoteliers’ subjective impressions.

On the other hand, those properties like Hotel C that have proper revenue management and online reputation are likely to stay profitable and outperform competitors in all parameters.

Free Ebook: 10 Things To Know About Revenue Management

This ebook is an introduction to revenue management for executives, general managers and hotel owners. Within the ebook “10 Things To Know About Revenue Management”, you’ll learn the principals of revenue management. Click here to download the Guide "10 Things To Know About Revenue Management".

Hopefully, this helps you better understand the thinking behind revenue management. More than a buzzword, when you incorporate revenue management into your hotel operations, then you’re well-positioned to achieve maximum profits. However, it does require an integrated combination of sales channels, distribution and reputation strategies, and market-oriented dynamic pricing.

Comments

Post a Comment